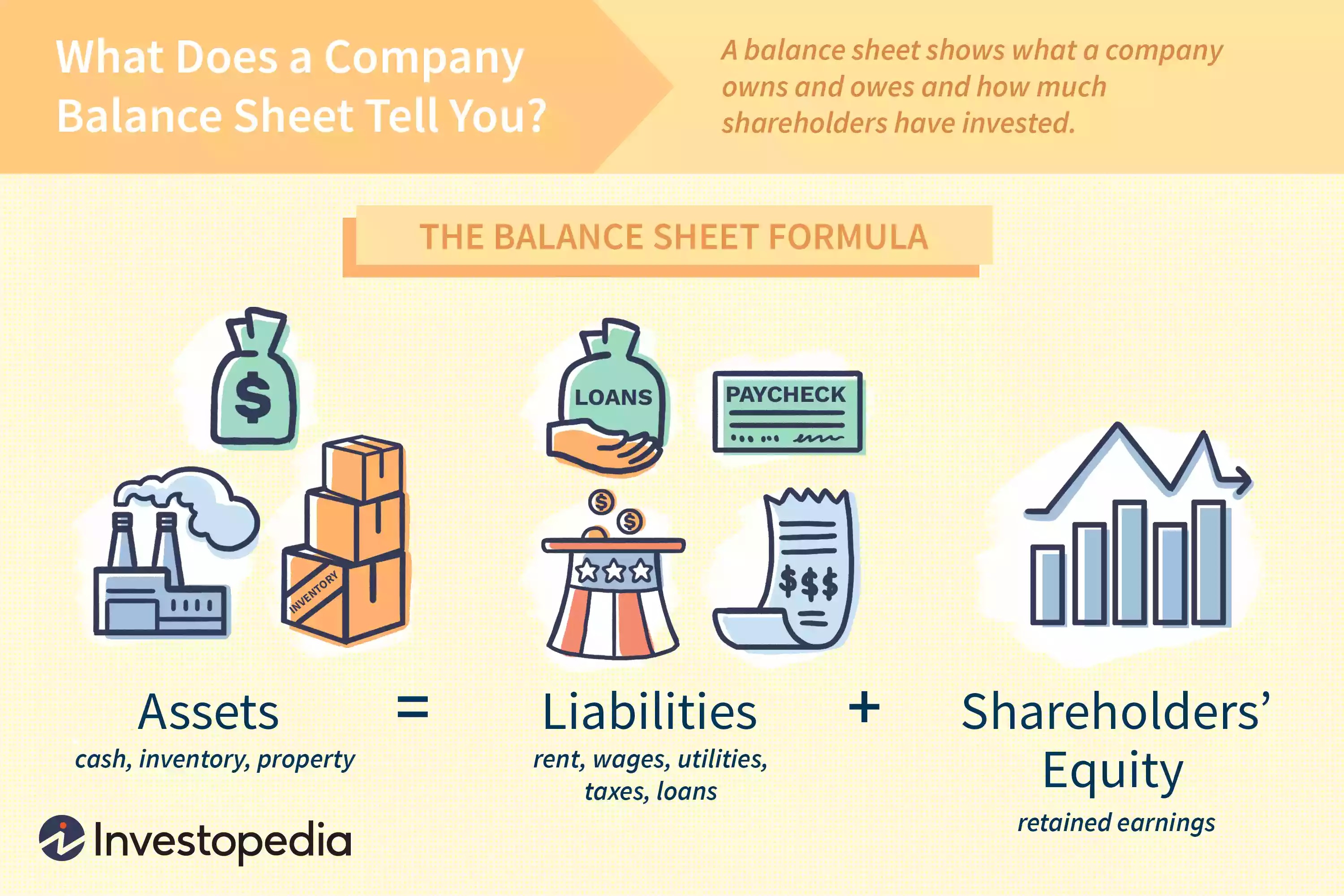

The balance sheet

The balance sheet (opens in a new tab) shows us the information of the company's assets, its obligations (its liabilities), and its equities.

An obligation (opens in a new tab) is the responsibility of a party to meet the terms of a contract or agreement. Individuals, corporations, governments, banks, and institutions—any entity that operates within a society—must regularly fulfill their obligations, or else face punishment.

A liability (opens in a new tab) is something a person or company owes, usually a sum of money. Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, bonds, warranties, and accrued expenses.

Assets = Liabilities + Equity

Why does the balance sheet show us the liabilities?

Because we do not only want a list of the company's assets, but also we do want to know where the money came from to buy those assets.

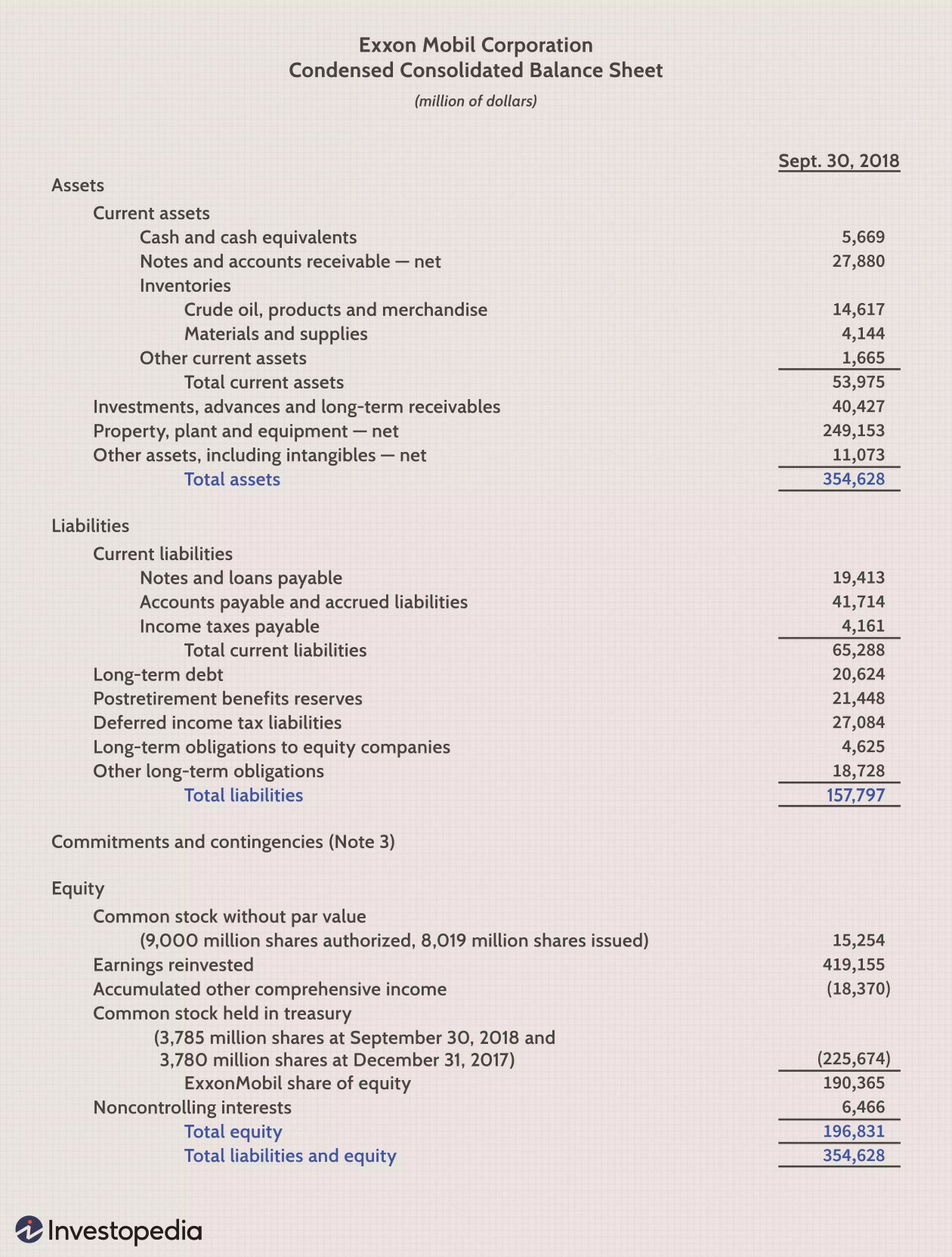

Let's look at an example of a balance sheet.

- Cash and cash equivalents: cash in all retail stores and bank accounts.

- Inventories: the stuff that the company sells to the customer.

- Property, plant, and equipment (PP&E): the company spent that amount of money to buy land, buildings, equipment, etc.

Question: The total company's assets on Sept 30th, 2018 was over $350B. Where did the company get the money to buy those assets?

Answer: The company can borrow the money, or the shareholder will invest the money.

- Accounts payable (opens in a new tab): Debts that must be paid off within a given period to avoid default.

Default (opens in a new tab) is the failure to repay a debt.

The company made some purchases and hasn't paid the supplier yet. This is the meaning of accounts payable.

With the inventories of ~$19B and the accounts payable of ~$42B, the company has already sold some inventory for which they haven't paid for it yet.

- Long-term debt: The company borrowed over $20B on a long-term basis.

- Earning reinvested (opens in a new tab): The number of historical profits generated by the company and has been kept in the company for growth purposes like to purchase new assets.

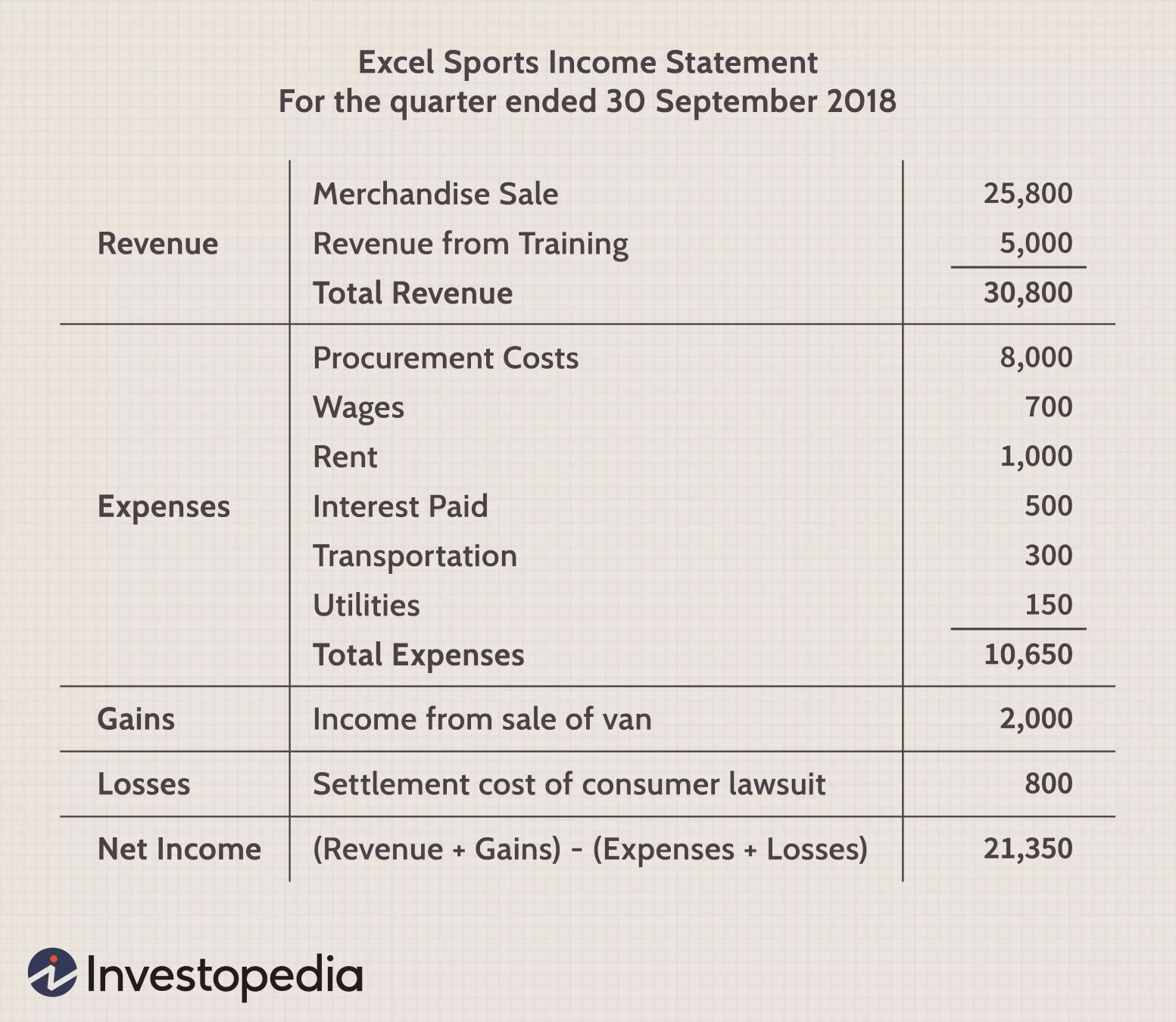

The income statement

The income statement focuses on the company's revenues and expenses during a particular period.

Net income = Revenue - Expense

Let's look at this example.

The company above has revenue of merchandise sales at about $26k. They use $8k to buy stuff from the supplier (cost of sales). On average, if they sell something that costs $100, they need to spend ~$30 (=8/25.8) to buy it from the supplier.

The company's net income is $21k. This means if the company sells something that costs $100 after they pay all the expenses, they get ~$70 (=21.35/30.8). This is super profit.

The cash flow statement

The cash flow statement shows the company's sources and uses of cash over a specified time period and is separated into three categories:

- Operating activities: collect cash from sales, pay cash for rent, utilities, taxes, interest, etc. These are done every day.

- Investing activities: invest in the productive capacity of the business. For example, buy/sell new/old buildings, machines, PP&E, long-term investment, etc. These are done occasionally.

- Financing activities: borrow money, manage investment, pay loans, pay dividends, etc.

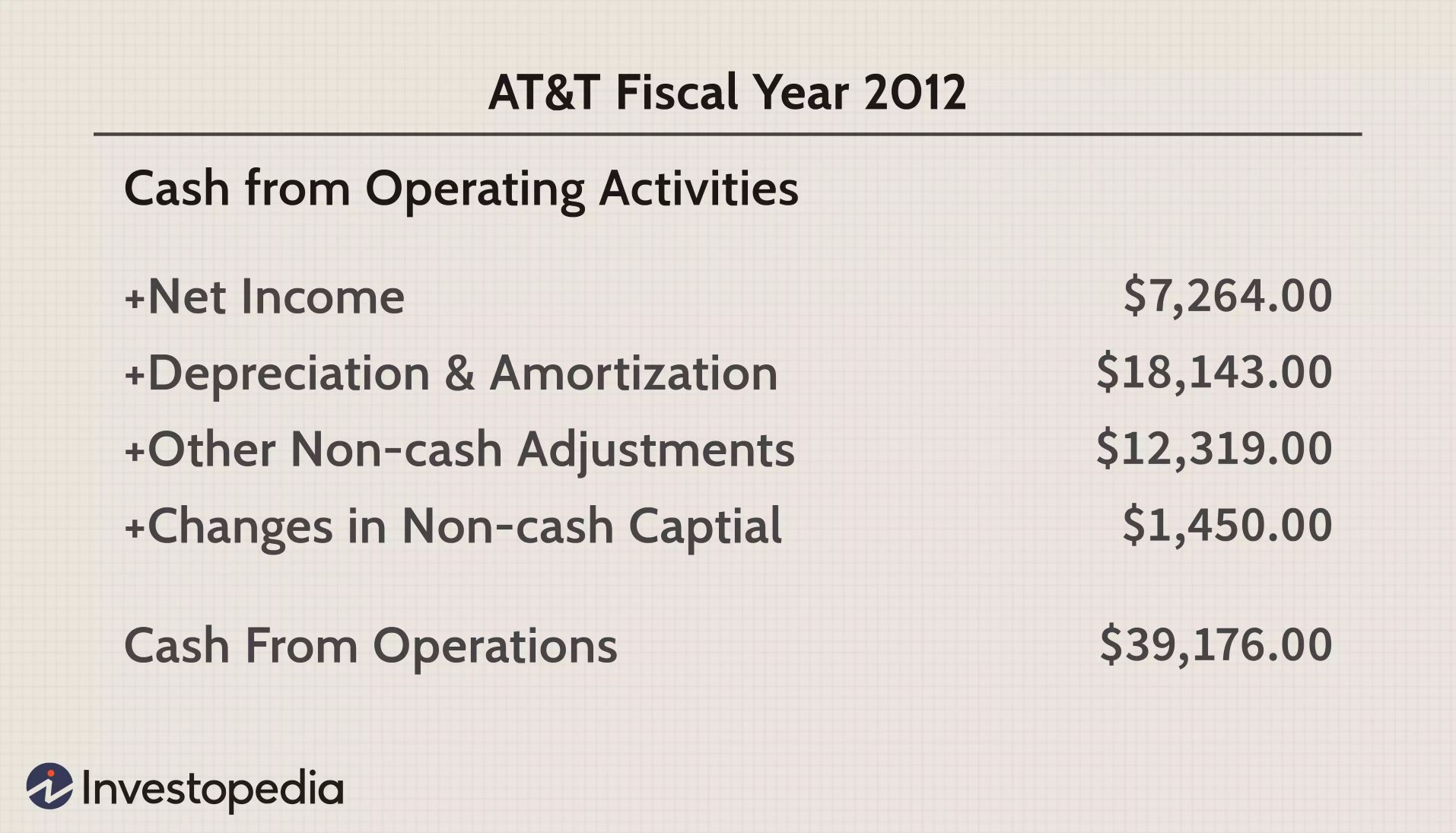

Let's look at an example of a cash flow statement from operating activities below.

The total amount of cash generated by operating activities of the company is $39k. The company will spend this money to maintain or expand the productive capacity (investing activities). This is called capital expenditures (CAPEX).

CAPEX: money spent by a business on acquiring or maintaining fixed assets, such as land, buildings, and equipment.

NOTE: The key in the cash flow statement is cash from operating activities.

Assuming the company spends $20k for CAPEX, the remaining $19k is called free cash flow.

Free cash flow (FCF) is the cash that the company is free to use. Free cash flow represents a company's financial flexibility.

The company can use this FCF to pay for the debt, pay dividends to shareholders, buy back shares of stock from shareholders, etc (financing activities).